Oil Stocks are Taking a Beating — But in 10-K’s, Not So Much

I have already warned you that if high quality financial statements from oil and gas companies are what you are looking for this year, you won’t find much of that in 2014 annual reports. In this post, I’m going to explain why all of the specialized O&G industry note disclosures will only add to the confusion.

Why Oil and Gas Accounting is a Mess in the First Place

Let’s back up a minute and review the accounting for oil and gas exploration and (E&P) activities. There may be no more extreme case of the failure of historic cost accounting to deliver relevant and timely information to investors.

Let’s back up a minute and review the accounting for oil and gas exploration and (E&P) activities. There may be no more extreme case of the failure of historic cost accounting to deliver relevant and timely information to investors.

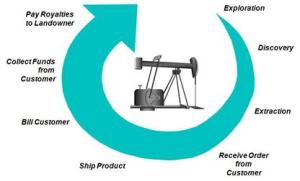

One doesn’t need to know much about the oil business to be able to figure out right away that the most significant event in the existence of an E&P project comes in the very early stages: the discovery of oil. But you couldn’t tell that from any income statement or balance sheet prepared according to GAAP. The effect on income is precisely nil until product is physically shipped to a customer. For the first barrel produced that could take a few years; and for the last drop it might be a few decades.

Initial attempts in the mid-1970s to make oil and gas accounting more sensible focused on the cost side — basically, whether to expense or capitalize the cost of “dry” exploratory wells. But, after holding public hearings, that somehow flew below the radar of Big Oil, the SEC bravely proposed to swallow the whole enchilada; it would depart from the historic cost basis by measuring the value of an oil field at the net present value (NPV) of its “proven” reserves. Known as Reserve Recognition Accounting (RRA), profits are initial recognized when a project adds to the NPV of those proven reserves. The NPV is subsequently adjusted as estimates are updated by new information or changing conditions (e.g., increases/decreases to crude oil prices).

IMHO, RRA was a masterstroke. But once Big Oil got wind of the SEC’s plans, they began lobbying in earnest. They argued that RRA was too subjective and too dependent on arbitrary assumptions. Well, duh, the exact same thing could be said about historic cost accounting.

But, the tacit reasons for pushing back on RRA are the same ones that we have come to numbly accept from the executive class of all companies. First and foremost, executives would have less control over what they would report as income under RRA. For most companies, revenue growth is hard, but once an oil field is producing, it could be as simple as opening the spigot a tad more. (It’s also the main reason why the GAAP financial statements of E&P companies mean very little.)

So, after about four years of back and forth and finally a flip in the leadership of the SEC from Democrats to Republicans, the SEC abandoned its RRA proposal. It would have been far too embarrassing to throw out all of the staff’s good work as if the RRA had no merit to begin with, so the SEC (through SFAS 69) was compelled to require supplemental disclosures based on RRA in the notes to the financial statements. This is also where information regarding economically recoverable quantities of oil were already being disclosed.

RRA Information Is Too Informative — So Let’s Muck it Up

The key to understanding what happened next is knowing that both the physical quantities of proved reserves and their NPV were based on current oil prices. Consequently, a drop in current oil prices would have the following two effects on these supplemental disclosures:

- Quantities of reserves would decrease; because at lower prices, some reserves reported in past periods would no longer be economically recoverable at the lower prices now being used.

- The NPV calculation would take a double hit: as above, fewer barrels of oil would be counted, and the NPV would decrease because future expected cash flows based on current prices would be lower.

So once again while Republicans controlled the SEC, Big Oil successfully lobbied for a change from current prices to average prices from the preceding twelve months. Under the guise of a larger effort at disclosure “modernization” and on their way out the door after Barack Obama was elected in 2008, here’s how the Commission rationalized the change:

“Most commenters on the Concept Release recommended that we replace our current use of a single-day, fiscal year-end spot price to determine whether resources are economically producible based on current economic conditions with a different test. Some believed that reliance on a single-day spot price is subject to significant volatility and results in frequent adjustment of reserves. [footnote omitted] These commenters expressed the view that variations in single-day prices provide temporary alterations in reserve quantities that are not meaningful or may lead investors to incorrect conclusions, do not represent the general price trend, and do not provide a meaningful basis for determination of reserve or enterprise value.” [italics supplied by me]

Wow. Let’s take a look at this piece-by-piece:

- Most commenters—Since when is the SEC in the business of counting votes, and are all votes equal? I LOL when I think about how the SEC ignored the protestations of “most commenters” who opposed eliminating the IFRS-to-GAAP reconciliation requirement for foreign companies listed in the U.S. — yet essentially the same group of Commissioners did it anyway. And, although I didn’t actually take a count, but who do you think comprised a majority of commenters—investors, or issuers with oil and gas operations? ‘Nuf said.

- Frequent adjustment of reserves—The values of marketable equity securities change frequently, but no one in this day and age would dare suggest, thank heavens, that prices should be past averages instead of the current market price. Why on earth should it be different for valuing oil that will come out of the ground tomorrow?

- Meaningful—I really dislike that flabby and vacuous word, and assiduously avoid using it in any context. But, I most especially dislike it when a financial regulator uses “meaningful” to be intentionally inarticulate about the relevance of the information that a rule would produce. Substitute “relevant” for “meaningful” in the SEC’s explanation see if it makes any sense. Gibberish.

- General price trend—If future prices of oil could be predicted by past prices better than the current price, then any person who can perform that trick wouldn’t have to actually work for a living. If anyone wants to bet even money that a12-month average price is a better predictor of the future price of oil one year from today than today’s price, I’ll take it — because I should be able to lock in a riskless profit by selling oil forward at the current spot price plus the cost of carry.

In the service of Big Oil, another generation of Republican Commissioners have done their duty. They have mucked up the disclosures so badly, that each analyst who would care to estimate just how much the decline in oil prices have soaked up shareholder value will have to do a lot more individual spade work — and hope they have come close to economic reality.

So much for investor protection.

* * * * * *

Paul Krugman recently reported that 87% of oil companies’ political contributions in 2014 went to Republicans.

If we only rely on the information reported in 10-Ks, we won’t have the slightest idea how profitable, in realistic economic terms, the oil companies were in 2014. But, you have to give them props for maximizing their ROI in Republicans.