How Deferred Tax Accounting Blunts Government Incentives to Invest in Renewable Energy

One of the items in my inventory of pet peeves when I first started blogging (six years ago!) was interperiod tax allocation, familiarly known as “deferred tax accounting.” I’ve always objected to it on theoretical grounds, and know that it owes its existence to political conspiracy.

The theoretical issues are pretty much covered in college textbooks, so let’s review them extremely cursorily:

- Are the potential future tax consequence of book/tax basis differences appropriately recognized as liabilities or assets? Not in my world. For one thing, if a company incurs losses, it won’t have future taxable income, and hence, won’t have to pay any income taxes at all.

- Assuming that a deferred tax liability/asset is appropriate to record, is it appropriately measured without taking into account the time value of money? Of course not, silly!

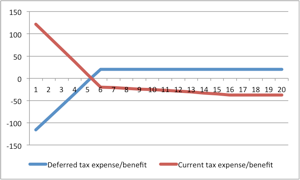

The political conspiracy angle is, somewhat understandably, given shorter shrift in the textbooks, and it derives from the theoretical questions. An empirical fact that I myself tested a number of years ago is that the ratio of reported “current tax expense” to reported net income before taxes is significantly lower than the statutory corporate tax rate. This is often due to timing differences like accelerated depreciation for the corporate tax return, but straight-line depreciation in the annual report to shareholders. Without interperiod tax allocation to recognize an additional component of tax expense, known as “deferred tax expense” corporation would look like they are not paying their ‘fair share’ of taxes. This would be unseemly; so, even though recognizing additional tax expense would reduce practically everyone’s reported income, issuers did not strenuously object since: (1) everybody had to take a hit; and (2) it made their effective tax rate look a lot more like the rate the generally public actually thinks corporations are supposed to be paying.

The Rest of the Story

Thus far, everything I’ve mentioned is old hat. But, there is another provocative question that I don’t think has had much traction: Does deferred tax accounting discourage socially desirable investment?

The reason I was thinking about writing this post is because I have a couple of friends in the solar construction industry, and my son actually worked for one of them as an intern. Below is a bare bones description of a typical project that, say, a public company like SolarCity, might undertake (N.B. nothing in this example is meant to be a reflection of SolarCity’s performance or strategy). The project could be put on the roof of your home, or on a vast expanse of government land in the Sonoran Desert:

- A separate legal entity, SolarCo LLC, is formed to construct a solar array for $1,200, which is financed 20% with equity and 80% with 15-year, 7%, non-recourse debt. (A high debt ratio is common due to the low-risk characteristics (primarily tax benefits) of the investment.

- For simplicity: assume that the company doing the accounting is the sole owner of SolarCo. In practice, the cash flows are prioritized among tranches of investors accepting various levels of risk, and with various appetites for tax losses.

- The economic life of the solar array is 20 years, and for tax purposes it is depreciated over five years using sum-of-the-years-digit depreciation with no salvage value. (I’m not using an official tax depreciation schedule — too lazy to look it up.)

- For simplicity: we will ignore the effects of the 30% investment tax credit that is available for qualified solar investments. The current ITC level is certainly attractive, but it doesn’t affect the point I am trying to make. (Moreover, my understanding is that ITC for solar investments is only in effect through 2016).

- SolarCo enters into an electricity supply contract with a single customer to sell the electricity generated by the solar array for $110 dollars per year.

- Again for simplicity, zero expenses other than depreciation and interest.

A 20-year time horizon makes for an awfully wide spreadsheet, so I’ll try my best to tell the story with graphs. Of course, you can peruse my full spreadsheet here.

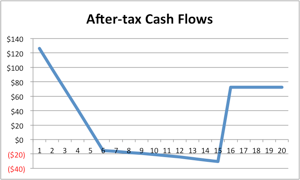

Let’s start with the after-tax cash flows (excluding the original investment outflow of $240):

At first blush, the cash flows are pretty strange; but if you are familiar with a leveraged lease, they follow that same pattern of positive in the early years, negative for a middle period, and positive again. One of the reasons I point this out, is that there is special accounting for leveraged leases that would not be eligible to a solar investment.

Also, on a cash flow basis (is there any other basis?) this is a very nice investment. The internal rate of return is 15%, which is very good considering that the majority of cash benefits come from risk-free sources.

As for the drivers of that crazy cash flow pattern:

- They start out positive (and decline rapidly) in the first four years due to the tax benefits of ridiculously accelerated depreciation.

- After Year 5, there is no more depreciation tax shelter; moreover, the after-tax cost of debt payments more than offsets the revenues from the electricity supply contract.

- Positive cash flows appear once again after the debt is fully retired.

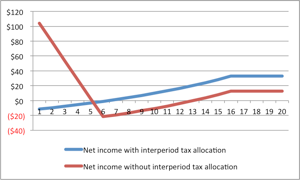

Now let’s check out the reported income over the life of the project. I’ve plotted income over the project life both with interperiod tax allocation (i.e., US GAAP) and without.

Before we consider the two lines separately, we should note that neither of them do a very good job of reflecting the performance of this solar investment. As we noted before, if everything goes according to a pretty firm plan, the investment will generate a 15% return every year. From the perspective of the underlying economics of this investment, there doesn’t seem to be much rhyme or reason to the volatility in net income.

The reason I wrote this post is for the blue line. As the CEO of this public company (and especially if your compensation were based on earnings performance), would you invest in this project?

Because of all that front-load deferred tax expense, the darn project doesn’t add a single dollar to earnings for seven years!

Notwithstanding the fact that it generates a low-risk 15% per year, it’s pretty obvious that many CEO’s would run away from this “opportunity.”

Looking at the red line in the income plot, we see a much more pleasing result to the eyes of the CEO. I’ll bet she’s planning to hold it for 4 – 5 years, and then sell it to someone else at a fair price for what they will be getting.

* * * * *

If the Obama administration comes to find out that arbitrary and capricious accounting rules are blunting its initiatives to provide incentives for clean energy investments, who knows? It could be the first step toward fixing deferred tax accounting.